Iyamoye Microfinance Bank

At Iyamoye Microfinance Bank, we believe that everyone deserves access to financial services that empower them to achieve their goals. We are committed to providing innovative, customer-centric solutions that foster financial inclusion, economic growth, and community development.

We Are

We have carved out a niche for ourself in the microfinance services industry as a leading microfinance bank accross Ijumu and Okun at large.

Our firm belief in the Nigerian economy has driven the continuous injection of capital by the shareholders to acquire new technology, recruit well-trained personnel in order to deepen financial inclusion of the underbanked

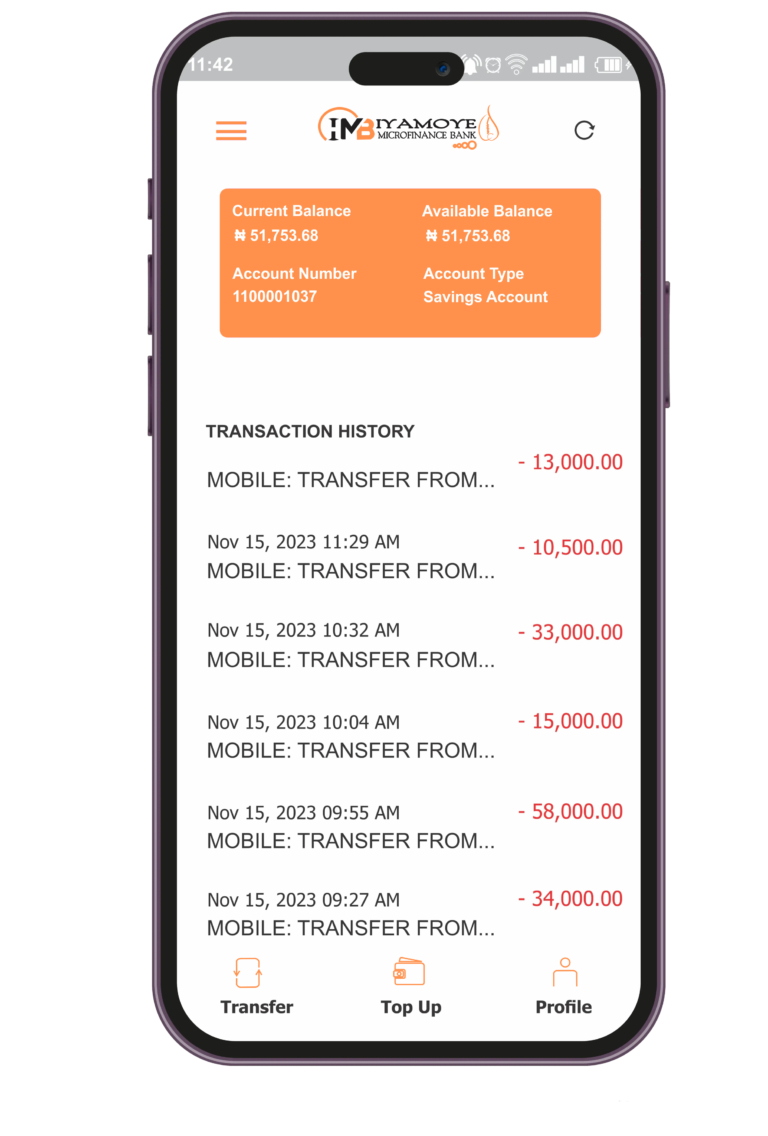

Everything you get with Iyamoye Microfinance Bank

Instant payment notification

High yielding deposit

Maximum security

24/7 customer support

Advisory Service

Business planning & funding

Instant acces to loan

And many more

About Iyamoye Microfinance Bank

Nurturing Businesses and Facilitating Payments

The Bank’s statutory obligation to the micro, small and medium scale enterprises (MSME’s) subsector of the economy is to accept and provide credit facilities to meet their unattended financial needs caused by their exclusion by major players in the financial services industry.

We strive to customize our products and services to target the poor but economically active to drive their inclusion into the financial ecosystem.

Click the below button to calculate your loan monthly repayment and interest rate

We offer banking to everyone

Easy Steps to Open Your Accounts

Easily create a free account for yourself and your business with these simple steps.

Opening and operating a bank account has never been this easy. We have removed all the hassles. Just provide your relevant information, and you have a bank account of your own.

Visit our website

Choose account type

Complete your registration details

start using your account

Our Working Hours

We are open Monday to Thursday, 8:00 AM – 3:00 PM and Friday, 8:00 AM – 2:00 PM

Please note that this working schedule does not recognize public holidays

Our Loan Products

SME Loan

Fuel your business growth with flexible financing solutions.

supporting small to medium-sized enterprises (SMEs) with working capital.

Agric Loan

Financial support for farmers and agricultural businesses to enhance productivity, efficiency, and growth, flexible repayment terms, competitive interest rates.

Individual Loan

Borrow for Personal expenses, medical bills, education, etc.

Finance your personal goals with flexible loans for various needs.

Salary Loan

Instant financial relief for employed individuals, borrow a portion of your upcoming salary to cover unexpected expenses or urgent need, borrow against your salary.